Objectives

Students will be able to:

• Discuss how the government measures unemployment.

• Describe the types of unemployment.

• Understand the causes of inflation.

• Analyze how inflation affects individual and business decisions.

• Discuss how the government uses fiscal policy to stabilize the economy.

Standards

NES: 18, 19, 20

ELA: 1, 3

Time Frame/Notes to Teacher

One day, double period

Materials

Textbook chapter on “Unemployment and Inflation.”

Teaching Strategies

I. Review homework on CPI and unemployment figures. Ask the following questions:

• From your study of economic indicators, in what direction do you think the economy is going?

• Do you think government should attempt to modify this direction? Why or why not?

II. Unemployment

Distribute Worksheet 11A, “How the Government Measures Unemployment.” Divide the class into

four groups and have them complete the exercise. Then have each group report back to the class on

one type of unemployment. Ask the following questions:

— What jobs and industries are prone to one or more types of unemployment?

— Is there any way to eliminate or ease the conditions that cause unemployment?

III. Inflation

Distribute Worksheet 11B, “Understanding Inflation.” Discuss the changes in spending and investing

that individuals and businesses make during a period of inflation. Ask the following:

— What type of hardship would rapidly rising prices place on a supermarket?

— How would a retiree on a fixed income fare during a period of inflation?

— What effect would inflation have on a business contractor?

— Would individuals’ savings change in value during inflation?

— How would inflation affect mortgage lenders?

— On the whole, would you say that the people you know are doing well in this economy?

— According to the data, what are the best jobs and industries to enter now?

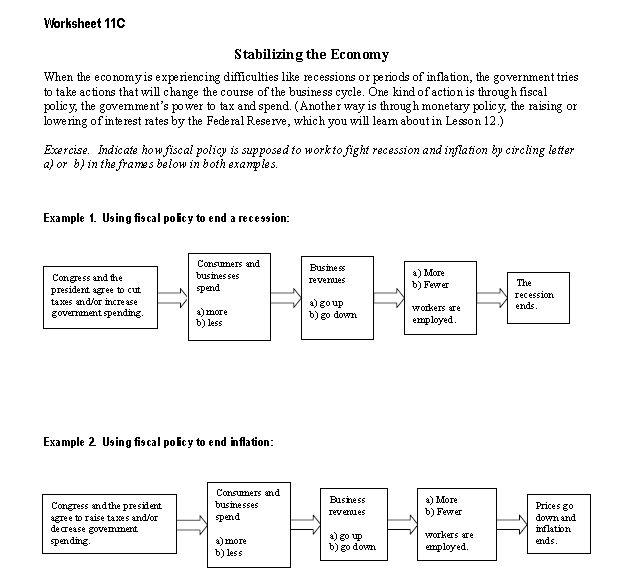

IV. Stabilizing the National Economy

Distribute Worksheet 11C, “Stabilizing the National Economy.” Have students complete the exercise

on the worksheet. Then have them explain their answers to the following:

— In your own words, what is fiscal policy?

— How do the charts show how fiscal policy is supposed to work to fight recession? How do the

charts show how fiscal policy is supposed to work to fight inflation?

— How can you explain that sometimes fiscal policy does not work or takes a long time to work?

Summary/Assessment

If we were to enter a period of recession, what would likely happen to the unemployment rate? The

inflation rate? The poverty rate? Explain your answer.

Homework

• Read materials in preparation for the next lesson.

• Assign questions for homework.

________________________________________________________

Worksheet 11A

How the Government Measures Unemployment

When workers are unemployed, they, their families and the country as a whole lose. Workers and their

families lose wages, and the country loses the goods or services that could have been produced. In

addition, the purchasing power of these workers is lost, which can lead to unemployment for yet other

workers.

To know about unemployment—the extent and nature of the problem—requires information. How many

people are unemployed? How did they become unemployed? How long have they been unemployed? Are

their numbers growing or declining? Are they men or women? Are they young or old? Are they white or

black or of Hispanic origin? Are they skilled or unskilled? Are they the sole support of their families, or

do other family members have jobs? Are they more concentrated in one area of the country than another?

After these statistics are obtained, they have to be interpreted properly so they can be used—together with

other economic data—by policymakers in making decisions as to whether measures should be taken to

influence the future course of the economy or to aid those affected by joblessness.

WHERE DO THE STATISTICS COME FROM?

Early each month, the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor announces the

total number of employed and unemployed persons in the United States for the previous month, along

with many characteristics of such persons. These figures, particularly the unemployment rate—which tells

you the percent of the labor force that is unemployed—receive wide coverage in the press, on radio, and

on television.

Because unemployment insurance records relate only to persons who have applied for such benefits, and

since it is impractical to actually count every unemployed person each month, the Government conducts a

monthly sample survey called the Current Population Survey (CPS) to measure the extent of

unemployment in the country. There are about 60,000 households in the sample for this survey. The

sample is selected so as to be representative of the entire population of the United States.

WHAT ARE THE BASIC CONCEPTS OF EMPLOYMENT AND UNEMPLOYMENT?

The basic concepts involved in identifying the employed and unemployed are quite simple:

• People with jobs are employed.

• People who are jobless, looking for jobs, and available for work are unemployed.

• People who are neither employed nor unemployed are not in the labor force

Employed persons consist of:

• All persons who did any work for pay or profit during the survey week.

• All persons who did at least 15 hours of unpaid work in a family-operated enterprise.

• All persons who were temporarily absent from their regular jobs because of illness, vacation, bad

weather, industrial dispute, or various personal reasons, whether or not they were paid for the time

off.

Unemployed persons are:

• All persons who did not have a job at all during the survey week, made specific active efforts to find a

job during the prior 4 weeks, and were available for work (unless temporarily ill).

• All persons who were not working and were waiting to be called back to a job from which they had

been laid off need not be looking for work to be classified as unemployed.

Excerpted from U.S. Department of Labor Bureau of Labor Statistics web site http://www.bls.gov/cps/cps_htgm.htm “How the Government Measures Unemployment.”

_________________________________________________________

Worksheet 11A, page 2

Exercise: After reading the textbook chapter, match the correct definition and characteristic with the

type. Fill in the number of the type before its definition and characteristic

1. Choose five people you know and classify them as employed or unemployed. Explain.

• If unemployed, what type of unemployment are they experiencing?

• If employed, are they susceptible to being unemployed in the near future?

2. Research the fastest-growing jobs/industries.

______________________________________________________

Worksheet 11B

The Fed Today: Understanding Inflation

DEFINITION AND CAUSES OF INFLATION:

• Inflation is defined as a rise in the general level of prices over a sustained period of time.

• Inflation can be caused by too many dollars chasing too few goods (demand-pull).

• Inflation can be caused by increased costs of making and selling goods (cost-push).

• Inflation is often measured by the Consumer Price Index (CPI).

HARMFUL EFFECTS OF RAPID INFLATION:

• Inflation decreases consumers’ spending power when their incomes don’t rise as rapidly as the overall

price level.

• Inflation may cause lenders to lose money because they may be repaid with dollars that have less

value than when they first made their loans.

• Inflation causes savers to lose money because a dollar they save today will have less value in the

future when it is spent.

• Inflation makes it harder for businesses to plan, which may reduce investment in future projects.

• Inflation causes owners of financial assets to suffer when those assets don’t increase in value as much

as price levels rise.

• Interest-rate-sensitive industries, such as mortgage lenders, may suffer as inflation drives up longterm

interest rates, and Federal Reserve tightening raises short-term rates.

• At a national level, monetary policy, designed to slow inflation, typically results in lost output and

employment in the short run.

______________________________________________________________

Worksheet 11B, page 2

How Inflation Changes Individual and Business Decisions

The Consumer Price Index (CPI) is the number used to calculate percentage changes in the average level

of prices for a basket of goods and services purchased by a typical urban family. The categories below

show some of the major components of consumer spending and indicate how the price level for the

overall CPI and these components changed on an annual basis from 1971 to 1981. The data suggest that

the overall inflation rate was at its highest level in 1980. On an annual basis for the components of the

CPI, the fastest annual increase was recorded for gasoline in 1980. (By contrast, in 1971, the slowest

annual increase was recorded for gasoline.)

________________________________________________

No comments:

Post a Comment